|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For pension

sponsors, consultants, and investment managers, the interesting

question is how to use this new tool. The

Using the

forecasts developed by their actuaries and their current

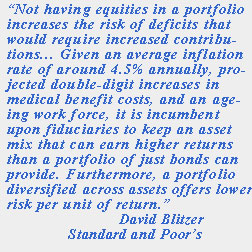

investment portfolio, the Utilizing the Pension Fund Analytics package, pension sponsors and their consultants can gain the benefits of duration immunization without the constraints imposed by an absolute reliance on fixed income instruments. Given today’s low interest rate environment, a lack of diversity in the investment portfolio increases both risk and costs. Dr. Frank Sortino put it rather succinctly, “We need to make sure we have grocery money for the next year or two, but we don’t need to have the cash now for the groceries 20 years from now. There is a difference between saving and investing. One should invest for long term needs and save for short term needs.”

- For more information on the theory behind the PFA Software Package please see our Problem / Solution pages as well as the Articles & Resources section - For more details about the software or to discuss with one of our analysts please contact us

|

most

obvious use for equity duration would be in combination with

bond duration and estimates for the duration of other classes of

securities to implement a better method of immunization. Toward

this end, we have developed the Pension Fund Analytics software

package to simplify this process.

most

obvious use for equity duration would be in combination with

bond duration and estimates for the duration of other classes of

securities to implement a better method of immunization. Toward

this end, we have developed the Pension Fund Analytics software

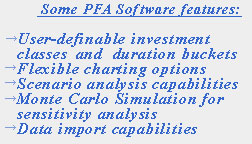

package to simplify this process. Pension Fund Analytics package allows pension sponsors and

consultants to see how their investment portfolio matches up

with their pension obligations. Users can easily define their

own investment classes and duration buckets. Charting options

allow users to quickly and easily present their findings. Users

can also perform scenario analysis to analyze how changes to

portfolio composition, contribution rates, and benefits affect

the health of the plan. Monte Carlo simulation will enable

consultants and plan sponsors to perform sensitivity analysis on

the portfolio and plan liabilities.

Pension Fund Analytics package allows pension sponsors and

consultants to see how their investment portfolio matches up

with their pension obligations. Users can easily define their

own investment classes and duration buckets. Charting options

allow users to quickly and easily present their findings. Users

can also perform scenario analysis to analyze how changes to

portfolio composition, contribution rates, and benefits affect

the health of the plan. Monte Carlo simulation will enable

consultants and plan sponsors to perform sensitivity analysis on

the portfolio and plan liabilities. -

See the

-

See the